123 PayStub Creator - Create Paystubs Online

- Step1: Create

- Step2: Preview

- Step3: Download Pay Stubs

Get First Pay Stub for Free

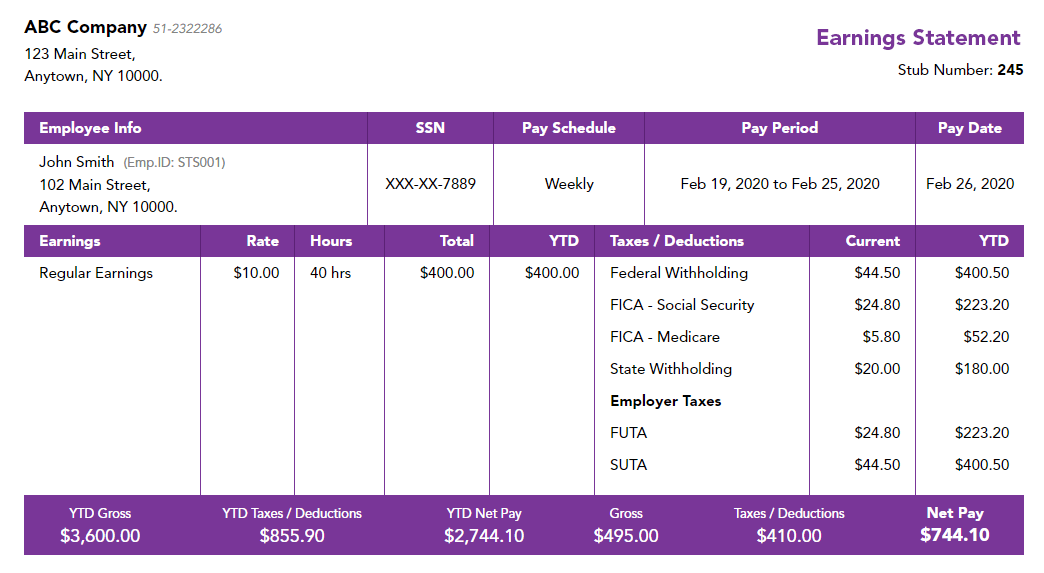

Fill in the information such as company info, employee info, and salary details.

Preview the information entered on the paystub and edit if you find any errors.

Finally, download, print, or email the paystub to your employees or contractors.

You can create paystubs for your employees or contractors easily and email them directly.

We support the new 2020 Form W-4 to calculate the withholding taxes accurately.

You can customize your paystub with the Year to date values and you can add your company logo on the paystub.

You can add additional income such as tips, commissions, bonus, overtime pay, etc.

We offer professional and realistic paystub templates to create paystubs. You can use any of the templates for free.

Create your first paystub for free with our paystub creator. After that pay the lowest price for each additional paystub.

You just need basic information such as company name, EIN, Address, employee name, ID, Address, and salary details. If you have this information ready, then you can create paystubs in less than 2 minutes. All the calculations are automatic and accurate with our paystub generator.

Visit 123paystubs.com/paystub-creator to know more about the paystub creator.

You can edit the paystub information before you complete the order. You can preview the paystub and check the paystub information provided on the paystub.

You can customize the paystub format by changing the paystub templates and the company logo without paying any additional amount. You can change the paystub template for free. We offer professional and realistic paystub templates for free.

Employers can e-file Form 941 easily with our sister product 123Paystubs. Just enter the required information, review the form, and transmit it directly to the IRS. The whole process takes only a few minutes. Also, you will get the filing status instantly.

123Paystubs offers the lowest price of $5.99 for filing Form 941 online.